On “deficit-financed” tax cuts

What’s the theory that some people use to argue that tax cuts are bad for us? I imagine they’re thinking about two issues — budget deficits and societal wealth — along these lines:

If Uncle Sam takes more money from people who are wasting it, that money can be put to better use. That would not only reduce our government’s budget deficit (because it will have more money), but the government investment would grow our economy more than would allowing the private sector to allocate that money.

If so, it’s a cute theory. Before accepting it, one should probably think about whether politicians and bureaucrats have track records of deficit cutting when revenues increase, of making wise investments with our tax dollars (relative to the private sector), and about the likelihood of those records (to the extent they exist) continuing.

Someone on the other side of this debate would have the opposite theory, something like:

If Uncle Sam takes more money from the private sector, it will be wasted by politicians and bureaucrats. It won’t reduce our government’s budget deficit (because as long as politicians can borrow money, they’ll do so, regardless of what tax revenues are), and it will lead to a poorer society because investments are better made by the private sector than by government.

I suspect that nearly everyone who asks questions like those above (about track records/likelihood of them continuing) is on my side of this debate, favoring lower taxes. But this post is mostly about a complaint on the deficit issue, rather than the question of how to create a wealthier society. I wish that this debate would focus solely on the creating-wealth side of the question, rather than the deficit-impact side. Why is that?

How likely do you think it is that:

- most politicians will spend all of the tax revenues at their disposal (rather than giving them back to the taxpayer or paying down debt),

- if they can borrow anything to supplement what is taken through taxes, they’ll do so, thereby adding to the debt, and

- government revenues are necessarily limited to what can be raised through taxes and borrowing, while desires about how to spend money are unlimited (particularly desires by politicians, as they’re spending other people’s money)?

Doesn’t asking these questions reveal an obvious answer?

Deficits are by definition the result of both the revenue and expense sides of the ledger, so pretending that more revenue will somehow suddenly result in lower deficits (instead of what we have historically seen: even more new spending) seems like the height of naivety.

This complaint was most recently prompted by someone who’s very sharp (Josh Brown) referring to recent tax cuts as being “deficit-funded.” When I hear that concept, my first thought is that it presumes that the money we earn belongs to the government. (Of course it doesn’t.) Another very sharp guy (Rep. Thomas Massie) articulated this point in an interview with Matt Welch last year:

“Here in Washington, D.C., they keep saying that tax cuts need to be “paid for.” That’s a ridiculous notion. I want to pull my hair out, or throw my shoe at people here in D.C., when they say tax cuts need to be paid for.

Spending needs to be paid for. Tax cuts do not need to be paid for. They’ve got the whole notion backwards.”

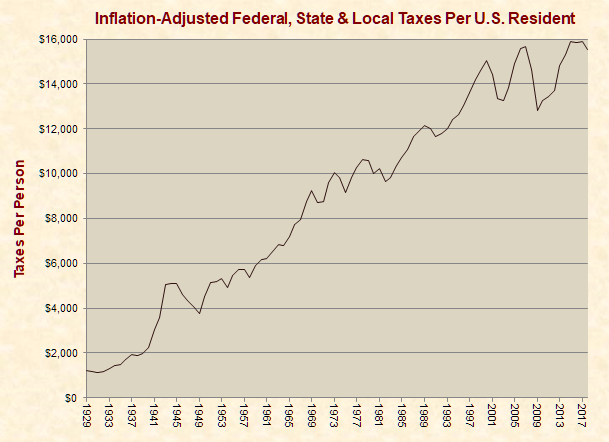

But after that philosophical thought passes, I’m left scratching my head about why anyone thinks that more tax revenues would do anything to result in lower annual deficits. Over the long term, we’ve had increasing tax revenues basically forever (note that these charts are adjusted for inflation):

From https://www.justfacts.com/taxes.asp

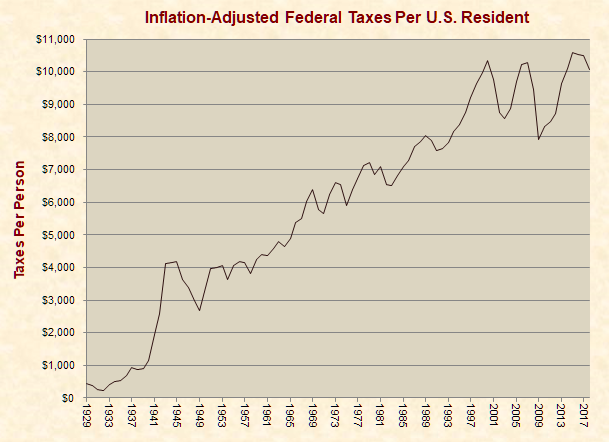

The federal-only version looks virtually identical, minus a few thousand dollars per person going to the states (for those looking at the y-axis, that’s a little over $10,000 per US resident/per year in 2017 going to D.C.):

From https://www.justfacts.com/taxes.asp

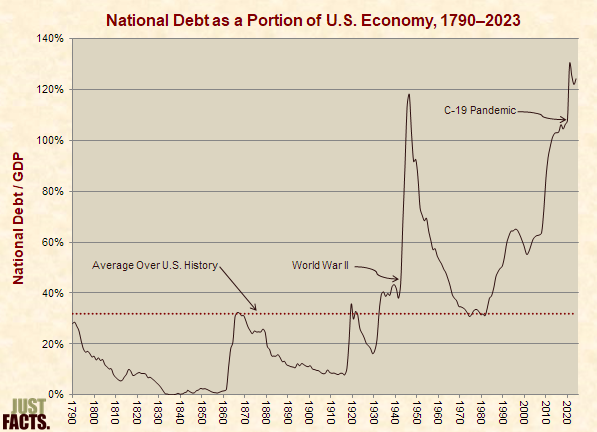

Yet the debt keeps growing despite all of that additional revenue… weird! You don’t need to see visual evidence of that, because you know it’s true, but here’s another chart that starts at the tail end of the Great Depression anyway:

From http://www.justfactsdaily.com/what-the-20-trillion-national-debt-means-to-you/

If you think these things should be measured by portion of GDP for some reason, the charts might look even worse to you (see the most recent 40-year run of increasing debt):

https://www.justfacts.com/nationaldebt.asp#quantifying

It’s almost like politicians’ spending urges are permanent and insatiable by more tax revenue, or at least they have been since the late 1970s/early 1980s.

My summary: tax revenues have been increasing more or less continuously over the last century (and longer, but I’ll spare you more charts). At the same time, surprise! Spending keeps going up too, but by more, as shown by the fact that the national debt is increasing.

In theory, politicians could use the additional tax revenue to pay for what they previously financed with borrowed funds. It’s just that they’ve proven incapable of doing so, and show no signs whatsoever of reversing that trend. But sure, if you think tax cuts are bad for us because they increase the deficit/debt, go ahead and stick with the talking point that they would shrink if we taxpayers were forced to cough up more of our money; keep calling them “deficit-financed” tax cuts.

*****

PS: Anyone leaning toward accepting that tax increases are good (or bad) for wealth creation should also think about the extremes. When do you stop taking money from people? When is the government “investment” giving a negative return, rather than growing the economy?

If you think tax cuts are bad for us because the politicians will spend the money better than the private sector, that’s a far more interesting discussion than whether tax cuts need to be “paid for” or not. If we’re in a place with substandard or non-existent rule of law or other basic prerequisites to wealth creation, then I bet you could make a pretty good case that politician-directed spending (on the right causes) could be more beneficial. However, if we’re in a place with lots of wealth creation, yet politicians are spending money on ridiculous, frivolous, immoral, and obviously-harmful causes, maybe you should think about reform before you try to give the politicians more control over society’s wealth.